Product Description

What is Dengue Costs with FREE COVID-19 cover*?

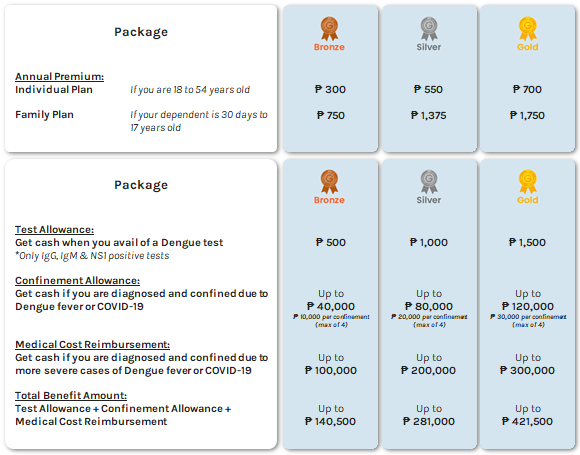

GInsure, in partnership with Singlife, offers Dengue with Free COVID-19 Cover* for as low as PHP300/year. Its multi-level benefit, worth up to PHP421,500, covers allowance for positive test results for Dengue and confinement, as well as medical cost reimbursement for more severe cases of COVID-19 and Dengue. It also comes in Bronze, Silver, and Gold coverage levels with different benefits and annual premiums.

*Limited offer!

How can I buy this product?

- You can buy this if you are:

- 18 to 54 years old

- a fully-verified GCash user

- in good health and has never been a ‘confirmed COVID-19 case’

- a Filipino citizen or a foreigner who is a legal resident of the Philippines.

What are the benefits of this product?

- Test Allowance

- Get cash when you avail of a Dengue test (only positive results).

- Only IgG, IgM & NS1 positive tests

- Get cash when you avail of a Dengue test (only positive results).

- Confinement Allowance

- Get cash if you are diagnosed and confined due to Dengue fever or COVID-19

- Medical Cost Reimbursement

- Get cash if you are diagnosed and confined due to more severe cases of Dengue fever or COVID-19

Who can be nominated as my beneficiaries?

- You can set at standard order or choose to name beneficiary/ies during purchase.

- The standard order is as follows:

- Surviving Legal Spouse;

- Surviving legitimate, illegitimate, legitimated, legally adopted children; or

- Surviving parents; or

- Surviving siblings

- Estate

- The standard order is as follows:

How many insurance policies can I avail from Singlife?

You can buy only one (1) policy of each GInsure product powered by Singlife. If you need a more comprehensive cover, you may upgrade to the highest coverage level.

How to purchase

STEP 1. Login to your GCash app, then click the GInsure icon

STEP 2. Choose any Singlife product for “Dengue with FREE COVID-19 Cover”

STEP 3. Choose your preferred plan type, coverage level, then provide the necessary beneficiary details if you chose the Family Plan

STEP 4. Review your policy details and tick the Declarations box

STEP 5. Click “Confirm and Pay”